Share this

The Tech Question All Bank Execs Should Ask

by Ronen Shnidman on Jul 23, 2016

The discussions on open banking until now have largely focused on enabling outside service providers to freely access bank customers’ data. But why aren’t bankers asking: What’s in it for me?

Of course fintech startups are for open banking, since they want to make money off bank customers’ data. But bankers should be excited to use open applied programming interfaces (APIs) to allow banks to use external data for improve customer experience and make smarter business decisions. So why haven’t bank executives taken the lead in pushing the open banking conversation in that direction?

There are at least several use cases where banks would benefit from using APIs to access non-bank data, but let’s focus on the more interesting ones related to better knowing your customers. Banks buy consumer data because of the many ways it can improve customer acquisition, customer onboarding and fraud prevention. However, the way most banks consume data today is an expensive, piecemeal fashion when they could do it cheaper, faster and on a larger scale using APIs.

Trimming the CAC

Banks’ average cost of acquiring customers lies somewhere around $300 per person and has grown rapidly over the past decade, drastically outstripping the rate of inflation. For example, in 2005, Arkadi Kuhlmann, then-CEO of ING Direct, told Bloomberg that the industry average customer acquisition cost (CAC) was $100 per person. In 2012, Brett King, the co-founder and CEO of mobile banking startup Moven, pegged the industry average CAC at between $250 and $350 per person in his book Bank 3.0. Compare that 200 percent growth in average CAC with a cumulative inflation rate of less than 18 percent from 2005 to 2012.

Clearly, banks are finding it harder to acquire new customers even with the shift toward increased digital marketing. How can bank executives rein in their escalating CAC? The solution is already being talked about: better cross-channel marketing.

But where many cross-channel marketing efforts fail is the lack of quality data (and the same is also true for the related strategy of omnichannel banking). To effectively engage in cross-channel marketing you must be able to:

- Find the various contact details of any randomly given person. In practice, this requires access to billions of records on people, since most records only contain partial data on one person.

- Identify and merge fragmented entries for the same person across your bank’s multiple technology platforms including CRM, BI and marketing databases.

- Qualify leads based on their basic signup information and then group them into marketing segments in order to deliver personalized marketing and product offerings.

Ignoring these basic data needs ensures that your state-of-the-art digital, email and direct mail campaigns are just updated versions of the “spray and pray” approach. Spending top-dollar on ad design and distribution while ignoring low conversion rates is a guaranteed way to see your CAC costs escalate like the rest of the industry.

This is why, paradoxically, some digital-only banks like Compte-Nickel in France and Tangerine in Canada actually find it cost-effective to have branch-like, physical locations to attract customers. Compte-Nickel decided to lower its CAC by partnering with tobacco shops in France to serve as registration centers for new clients. Tangerine has long maintained several “Tangerine cafes” for the same reason. When asked, Compte-Nickel CEO Hugues Le Bret told American Banker that online banks in France spent on average $220 to acquire new customers. He believes that partnering with physical outlets just to acquire customers would be cheaper than relying solely on marketing channels. Interestingly, no one at established and challenger banks until now has talked about rising CAC and open banking in the same sentence.

The sad, amusing truth is that other industries have already adopted technology to improve lead targeting and qualification as far back as a decade ago without drastically altering their business models. They did this by connecting their CRMs and other software databases to external consumer information providers via API. Banks have simply been held back by their refusal until now to integrate third-party APIs into any of their systems.

Customer Onboarding

Convenient UX and easy customer onboarding is something that the digital-only banks like Tangerine and Moven already get right. But it’s something that a lot of community banks and even some of the big multinational banks could improve upon through open banking APIs.

The era of long-winded application forms that ask you for all your contacts details, personal information and the kitchen sink is coming to an end. Take a look at the above links to two digital banks to see what a slimmed down application form should look like. What they ask customers to provide is quite minimal:

- A Social Security or Social Insurance number

- Email address

- Street Address

- Phone number

- Any other information they are legally obligated to gather

The time these simple forms save for hot leads ensures that abandoned sign-ups are minimized and the customer’s first experience with the bank is likely to be a positive one. Today, the abandonment rate for banking applications online is 97.5 percent according to senior Forrester analyst Peter Wannemacher. Reducing this huge abandonment rate is both crucial to reducing CAC through a higher conversion rate and is an important goal in its own right.

The motivation behind longer, traditional forms is to get additional customer data for informed product offers from bank representatives and for risk management, but these needs can now be addressed without burdening the customer.

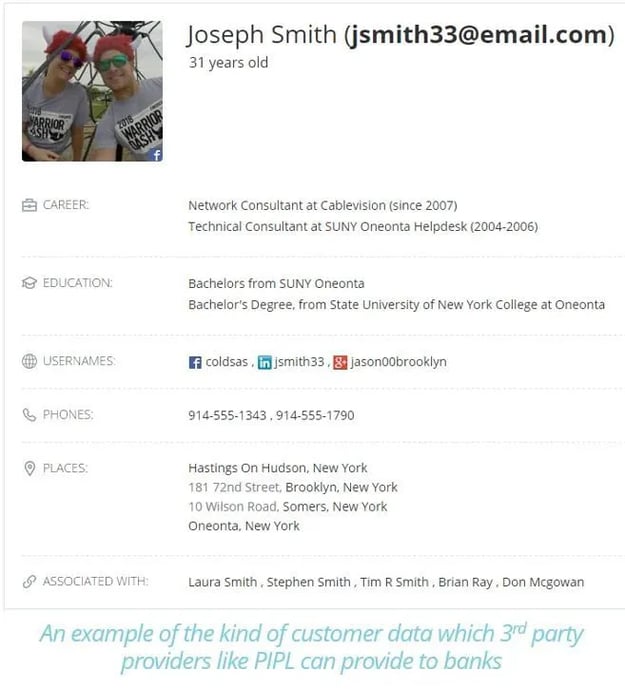

Using only the above data points, banks could easily send an API query to one of the third party information providers out there and find out a client’s:

- Age, gender and past addresses

- Profession and educational background

- Country of origin, preferred language

- Social media handles

If you go beyond pure personal information to include other types of data providers in the market, the relevant information you could find with same basic starting points widens to include:

- Independent estimates of household income

- Consumer preferences (e.g. choice of automobile)

- Media preferences (e.g. newspaper and TV vs. online)

There is no requirement for a client to walk into a branch to allow a bank employee to gather this information. Divorcing the bank’s desire for gathering additional client information from what can be a stressful and confusing account opening process can only help banks sign up more clients and keep customers happy.

Preventing application fraud

Much like card-not-present fraud, banks must increasingly worry about account application fraud as customers increasingly open and change account details online and not in person at branches. Already the cost of all types of bank account fraud, is significant. The Financial Brand’s Ron Shevlin found that the median annual total fraud loss was $4.53 per checking account based on community bank benchmark data.

That cost can be expected to grow as most fraud industry groups have noted a trend of increasing attempts at new account opening and account takeover fraud. The biggest cost this fraud wave has for banks is that it obligates spending more resources on manual review of applications. Already bank fraud managers’ report that they spend 52 percent of their annual budgets on manual review according to Equifax. Fraud prevention solution providers that use people, device and behavioral data to flag high risk account openings have already saved bank clients millions of dollars per year in prevented fraud losses and reduced manual review time.

Instead of banks each testing black box solutions that can only assist in fraud prevention, they could directly feed via API the data that power these anti-fraud solutions into internal tools used across the bank. By connecting directly to data providers or to a third party API layer, like Plaid, banks can control and fine tune their fraud prevention systems to what works best for their specific circumstances. This means bank staff would know in seconds if an account was at high risk for fraud. Your bank could determine if the person who just opened an account used an email that was created just months ago (i.e. high risk), of if they provided a cellphone number associated with an unrelated person (i.e. possible SIM card swap fraud) or a spouse or immediate relative (low-risk) and more.

This KYC (know your customer) information could also help bank staff provide better customer service. For example, a legitimate customer who opened an account with a new email address may not be a good prospect to sign up for mobile banking. To take another case, a customer service rep dealing with a complaint on social media could link the social profile with an existing account-holder and offer faster and more personalized service.

Using third-party APIs means banks no longer need siloed black-box solutions for each department’s pain points. The best solution will create synergies across the entire organization without paying for the same information multiple times.

Making open banking benefit bankers

I’ve been waiting to hear bank execs and non-IT employees talk about leveraging all that open APIs have to offer banks. I’m a pretty avid reader of both the financial and trade press and I’m surprised I still haven’t seen a real discussion about this anywhere.

The few exceptions have been a handful of lengthy interviews with people working on APIs inside banks, but that is only one side of the equation. I also wonder how much impact they will have on how the entire industry operates since they represent just one bank department among the many that would be affected by truly embracing the API revolution.

Original blog post written by former Pipl Technology Evangelist Ronen Shnidman. Ronen is now Managing Editor @ about-fraud.com

All Posts

All Posts