Share this

Why AVS Is Costing You Money

by Ronen Shnidman on Mar 5, 2016

There is no such thing in life as a free lunch, and the credit card companies’ AVS anti-fraud service is a prime example.

Online transaction fraud is a growing threat to merchants’ bottom-line that isn’t adequately addressed by the credit card network’s legacy fraud prevention systems. In the U.S. alone, one in six merchants’ legitimate cardholders experienced a credit card decline in 2014 according to a study conducted Javelin, costing businesses an estimated $118 billion in lost revenue. The weakest link at the moment is an outdated address verification system (AVS) that causes merchants to leave far too much money on the table and insult legitimate customers.

The biggest problem AVS poses for large ecommerce operations is geographical. There are no markets outside of the U.S., Canada and the U.K. where all major credit card networks provide AVS. Customers using credit cards issued by banks located outside these countries will often receive an AVS decline on their purchases. A merchant can still accept these transactions but assumes chargeback liability, leading many to leave money on the table out of fear of fraud losses.

Since traditional AVS is useless in these situations, merchants that don’t want to lose these transactions must rely on other tools to avoid incurring serious losses to fraud. However, most anti-fraud alternatives, such as 3D Secure, aren’t fool-proof and add another layer of friction that can turn off potential customers.

Exploding cross-border commerce

Before this decade, when U.S. ecommerce transactions were almost entirely domestic, this may have been an unfortunate but acceptable source of pain for ecommerce players.

Today, the problem is growing to insufferable proportions as online transactions go global. During this past year’s Christmas holiday shopping season, a peak time for fraud, international sales at global retailers grew 22 percent by value according to benchmark data provided by fraud solution provider ACI Worldwide.

This past Christmas wasn’t a one-off. Cross-border B2C ecommerce is expected to grow to $1 trillion by 2020 according to a research report by Accenture and Alibaba Group. The report estimated this B2C segment will grow at a breathtaking compound annual growth rate (CAGR) of 27 percent per year until it accounts for 30 percent of global B2C transactions.

Meanwhile, the study forecasts that the number of cross-border ecommerce shoppers will multiply to 940 million individuals during the same timeframe. Do you want to insult close to 1 billion potential customers?

No wonder that fraud prevention platforms like Riskified are advising clients serious about international ecommerce to ignore AVS declines to maximize revenues and profit. This doesn’t mean you need to blindly approve international transactions or abandon address-based fraud scoring altogether.

Instead of relying on AVS, you can utilize a fraud prevention platform that provides better-than-AVS address verification capabilities using 3rd party identity data, like the information supplied by Pipl.

Pipl is AVS for global commerce

Through Pipl’s People Data API, fraud platforms and merchants can:

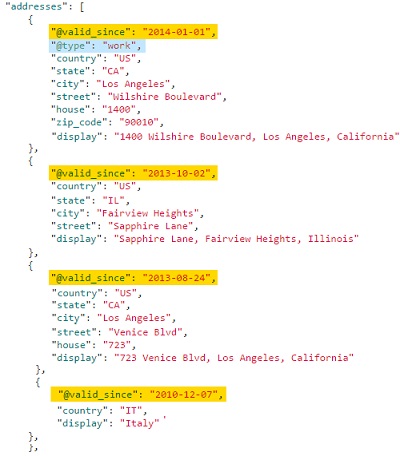

- Locate multiple addresses associated with the customer’s name and other contact details, such as phone number, email and social media profile. Matching the shipping and/or billing address with customer’s name indicates reduced fraud risk.

- Pipl’s data often includes both work and home address, so you are unlikely to deny an order from a customer who mixes up shipping and billing addresses. Traditional AVS only provides the customer’s billing address on file at the issuing bank.

- Create a fraud score based on the age of customer data. Thorough fraudsters may create fake names, addresses and emails but seldom is this fraudulent data very old. The lack of aged data associated with a customer’s name and address represent a heightened risk of fraud, their existence indicates the opposite.

- Some heavily populated areas around the globe lack a standardized address system. Pipl’s identity clustering of contact information, age, gender and other demographic data provide other contextual information you can use to create a fraud score when address data fails. For example, if a client provides a D.O.B. (date of birth) that doesn’t match their Pipl identity profile, they may be a victim of account takeover.

Pipl is true AVS for domestic ecommerce

Using Pipl to verify cardholders, helps you or your customers safely earn a slice of the global ecommerce pie and avoid big fraud-related losses, but the benefits extend to domestic CNP (card not present) transactions as well.

By providing multiple addresses, Pipl can help ensure that you don’t flag as fraudulent purchases by:

- College kids who list their school-year address instead of their home billing address.

- Customers who moved addresses but have yet to change the billing address on file at their card issuer.

- Customers that receive partial AVS declines caused by “fat fingers,” i.e. people who mistype their zip code or street address.

These mistakes may seem small and trivial, but that can be exactly what makes the “insult factor” for customers so huge. “What do you mean you declined my purchase because I got one digit wrong in the postal code?” is an AVS mishap you won’t hear when using Pipl data. The permanent loss of a customer’s business can have a significant impact on your bottom-line.

The Javelin study we mentioned earlier found that 32 percent of legitimate customers that received card declines stopped shopping with a merchant altogether, while another 26 percent reduced their volume of business with the merchant. That’s how U.S. businesses lost $118 billion in revenue in 2014, while trying to prevent just $9 billion actual fraud. As ecommerce goes truly global that disparity will only grow.

So, do you want to rely entirely on the credit companies to tell you who is fraudster or do you want to grow a global business?

Original blog post written by former Pipl Technology Evangelist Ronen Shnidman. Ronen is now Managing Editor @ about-fraud.com

All Posts

All Posts